IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

IRS Says Cost of COVID-19 PPE Qualifies as Medical Expense

Medical Expenses under IRS Section 213(d) — ComplianceDashboard: Interactive Web-Based Compliance Tool

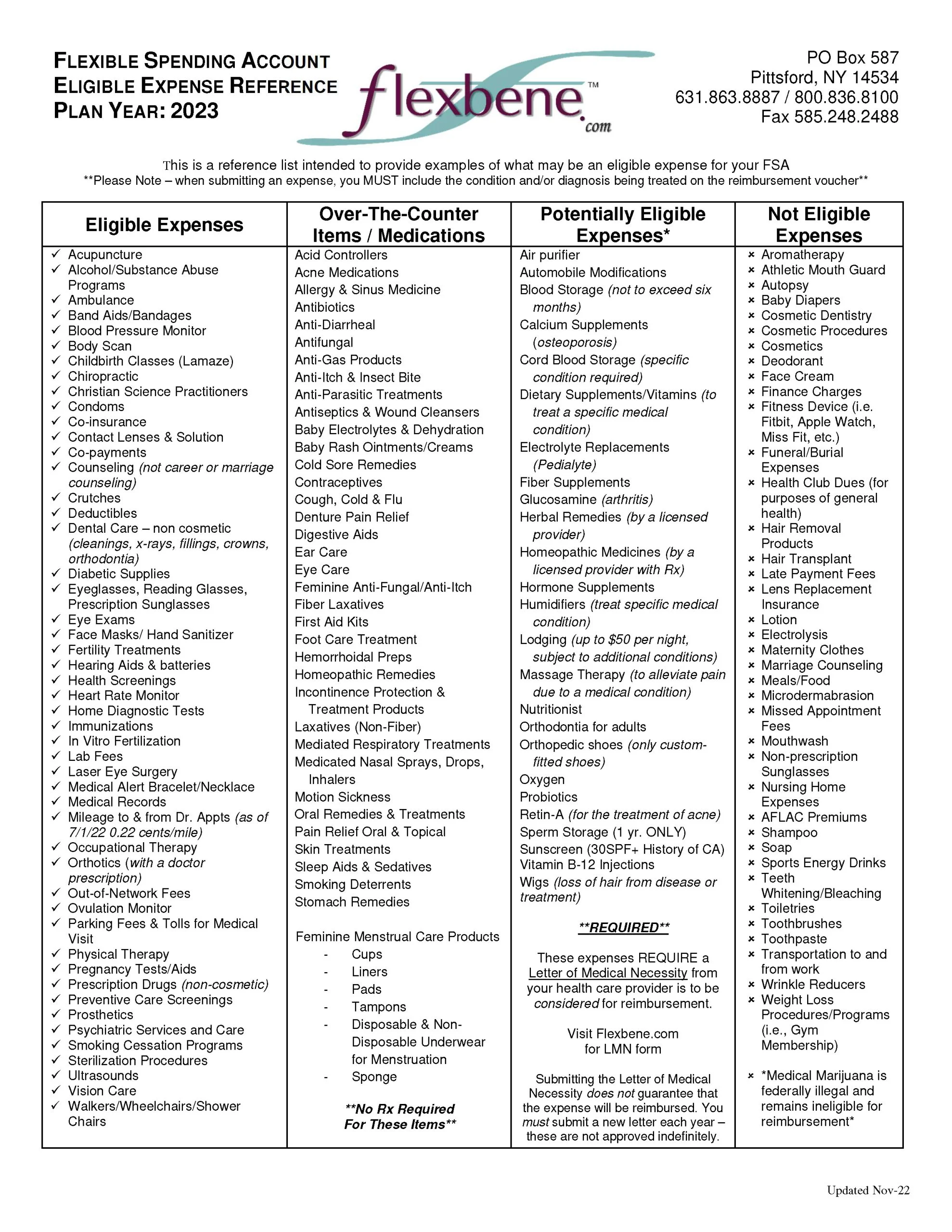

FSA Eligible Expense List - Flexbene

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible - Fill and Sign Printable Template Online

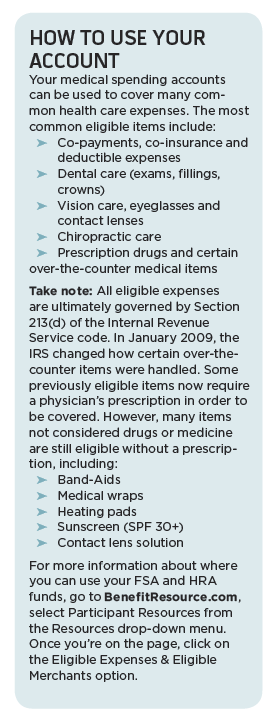

The FYI on your FSA and HRA, Illness And Wellness

ADP Eligible Expense Guide - ADP Learning Center

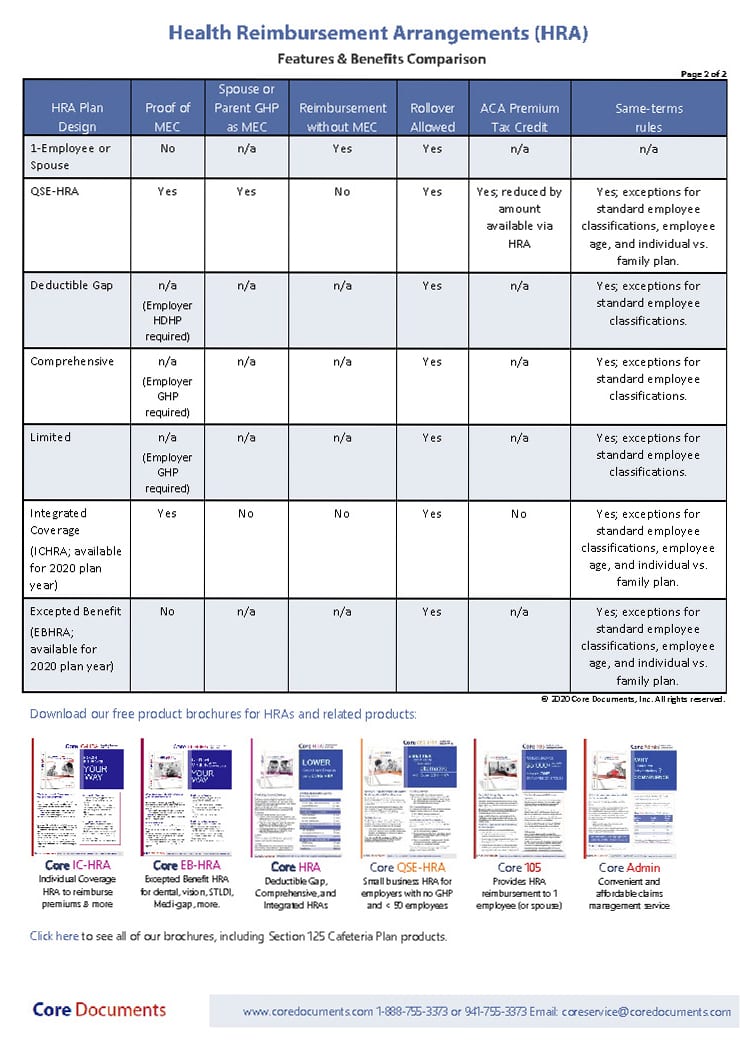

Compare 2024 HRA options with this handy tool from Core Documents

Using Flexible Spending Account Money On Urological Supplies

Flexible-Savings Accounts: What Expenses Qualify? - WSJ

WEX Benefits FSA Flyers Combined

Personal Spending Accounts

Publication 502 (2022), Medical and Dental Expenses