Williams-Sonoma: Valuations Suggest Risks Worth It (WSM)

Williams-Sonoma: Valuations Suggest Risks Worth It (WSM)

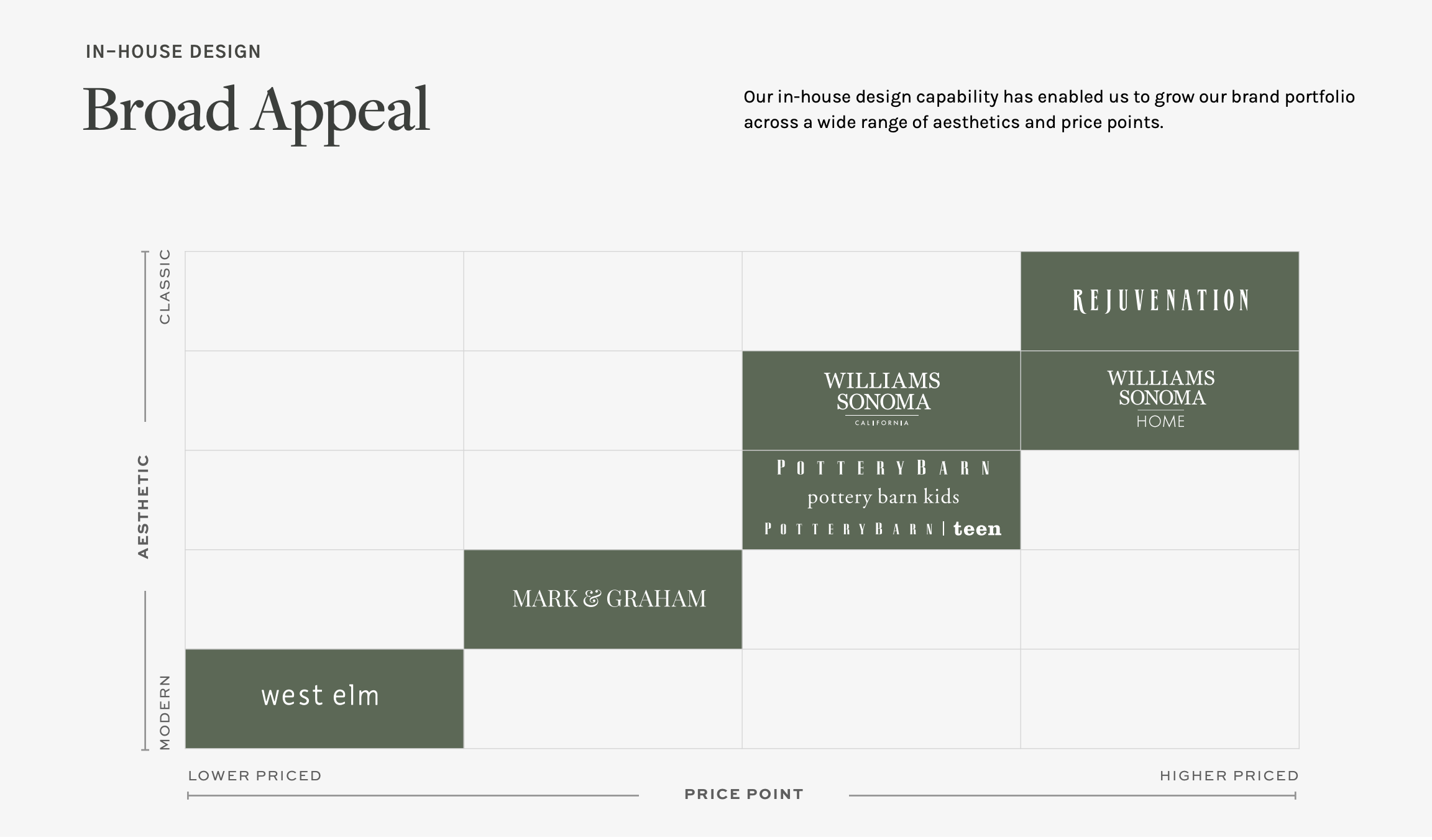

Williams-Sonoma, Inc. is a specialty retailer that offers various home products. Click here to read why despite the risks, we think the stock is a buy.

Williams-Sonoma: Very Undervalued For The Long Run (NYSE:WSM)

Is Williams-Sonoma, Inc. (WSM) Stock Trading Below Fair Value?

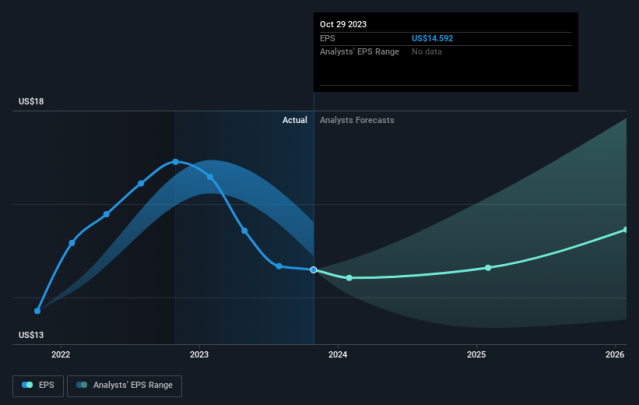

Williams-Sonoma (NYSE:WSM) Misses Q3 Sales Targets, Full Year Revenue Guide Lowered

What are the Strengths, Weaknesses, Opportunities and Threats of Williams- Sonoma, Inc. (WSM). SWOT Analysis.

Williams-Sonoma: A Thriving Retailer At A Discount

Williams-Sonoma: A Thriving Retailer At A Discount

Williams-Sonoma Inc (NYSE:WSM) - TheBright01

Williams-Sonoma (NYSE:WSM) shareholders have earned a 38% CAGR over the last five years

Curious about Williams-Sonoma (WSM) Q3 Performance? Explore Wall Street Estimates for Key Metrics

Options traders discounting retail rally?