How does sales tax work on discounted goods?

How does sales tax work on discounted goods?

Learn the complexities of applying sales tax to discounted products. From cash discounts to coupons, navigate the rules with this comprehensive guide.

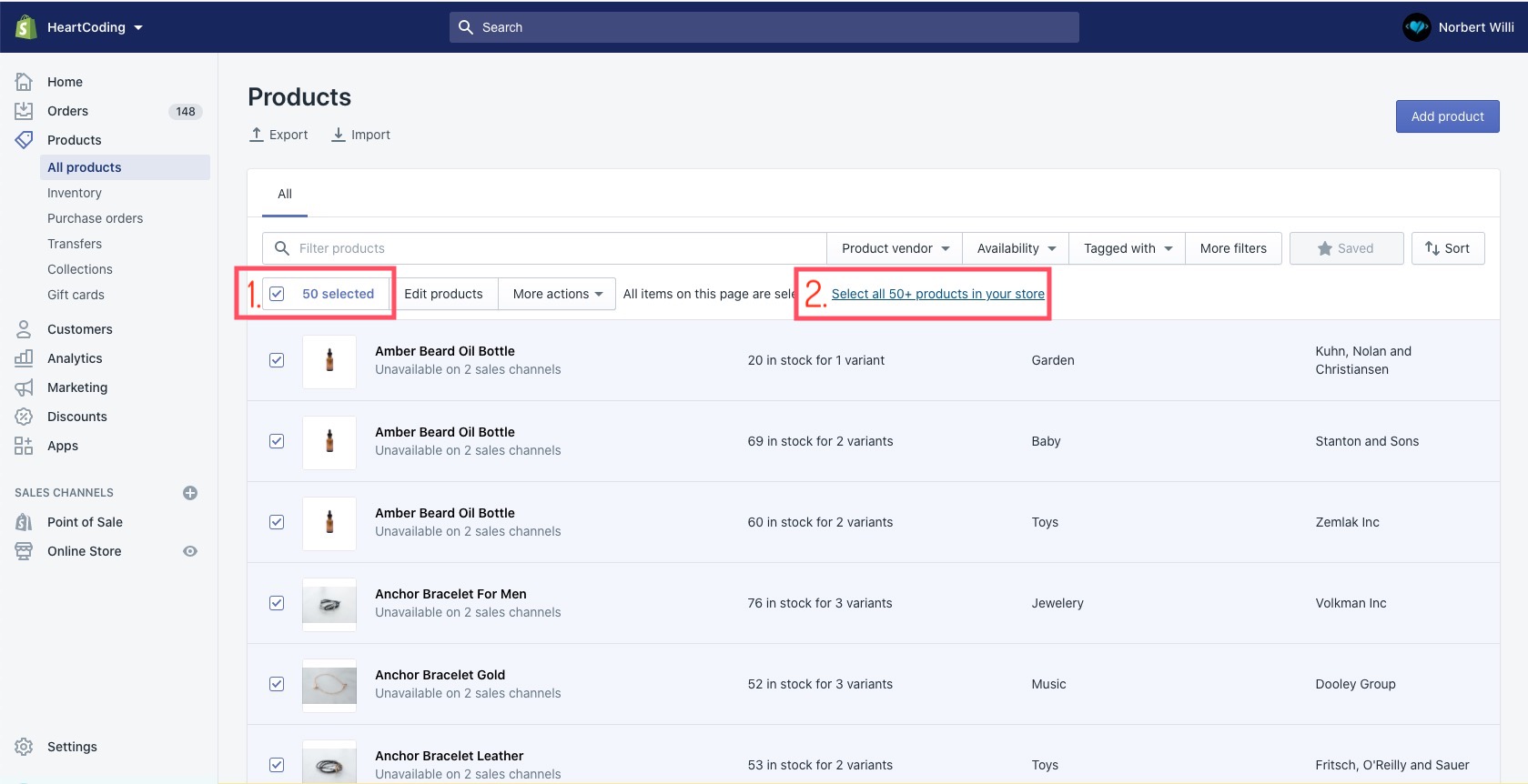

SOLUTION: 5 f3 returns discount sales tax - Studypool

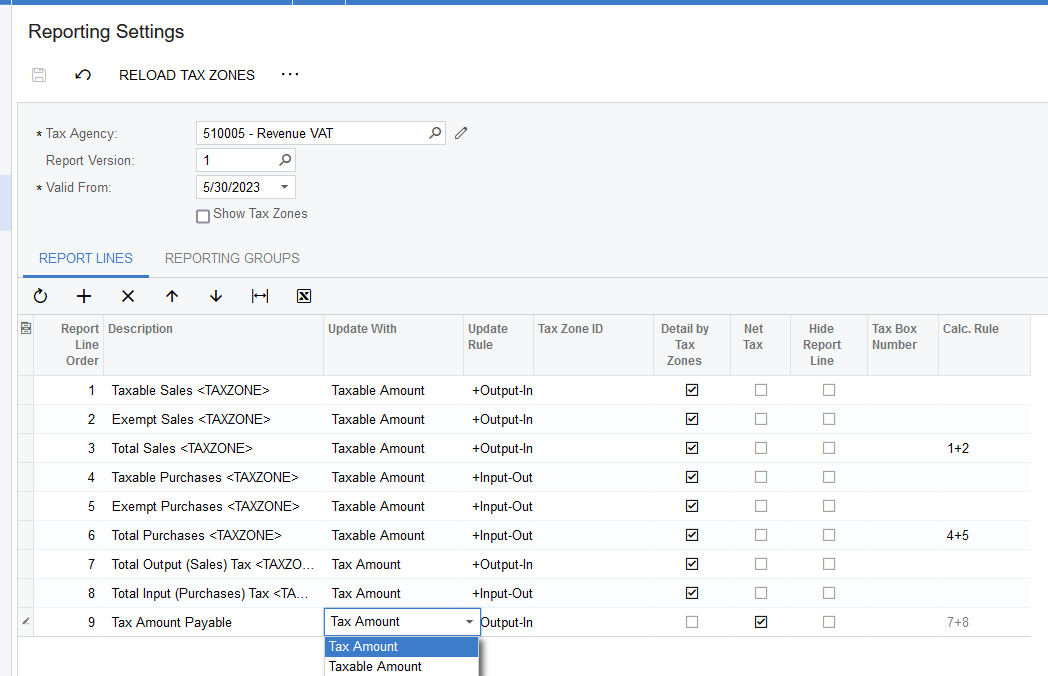

How to configure the VAT tax settings so that we can generate a tax report with whole sales amount and cash discount displayed separately?

Illinois Small Businesses: Upcoming Aug 5-14 Sales Tax “Holiday” Is Anything But One

Prince William County Emergency Management on X: Virginia's 3-Day Sales Tax Holiday is October 20 - 22, 2023! You can buy qualifying school supplies, clothing, footwear, hurricane and emergency #preparedness items, and

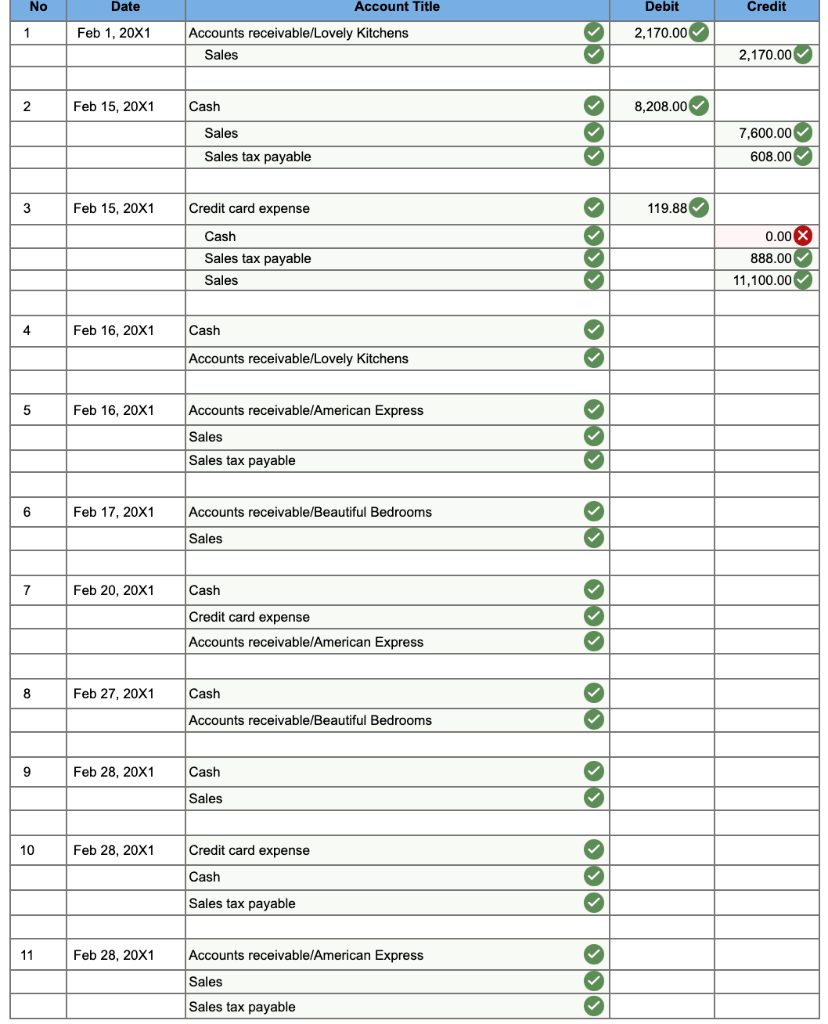

Solved DATE TRANSACTIONS 20x1 Feb. 1 Sold crystal goods to

Iowa's Local Option Sales Tax: A Primer - ITR Foundation

Sales Tax And Discount – Quiz Shop

Sales Tax, Sale Price, & Discount Tic-Tac-Toe

:max_bytes(150000):strip_icc()/DiscountedAfter-TaxCashFlow_v1-5c498601a91245589d4cf18fabe21981.jpg)

Discounted After-Tax Cash Flow: What It Is and How It Works

In many states you pay sales tax on items you buy. This sales tax is a percent of the purchase price. A tax percent is also called a tax rate. A desk.

Sales Tax, Blog

Understanding California's Sales Tax

Sales Tax, Tip and Discount Video

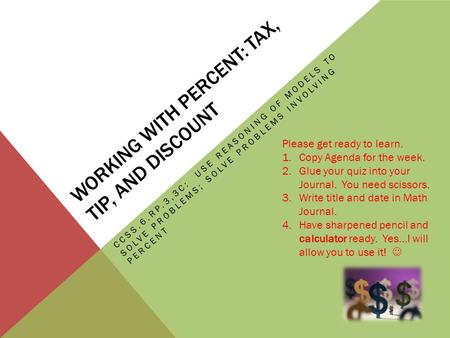

Sales Tax and Discount Lesson 8-5. Sales tax and discount Sales tax - is an additional amount of money charged on items people buy. The total cost is. - ppt download

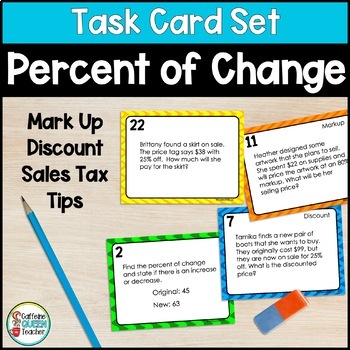

Reinforce how to calculate the percent of increase or decrease, discounts, markups, tips, and sales tax with these 24 task cards. These task cards are

Percent of Change with Tips Discount Markup and Sales Tax Task Cards