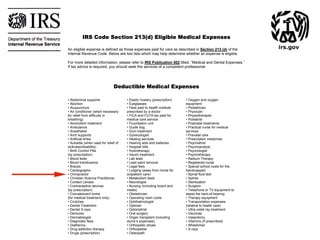

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

Personal Spending Accounts

Understanding 213-D Reimbursements or Health Wallet

HRAs, HSAs, and Health FSAs – What's the Difference? - Innovative Benefit Planning

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible - Fill and Sign Printable Template Online

HSA and FSA Facts for Health Care

2024 COLAs - Health FSA, Qualified Transportation and More

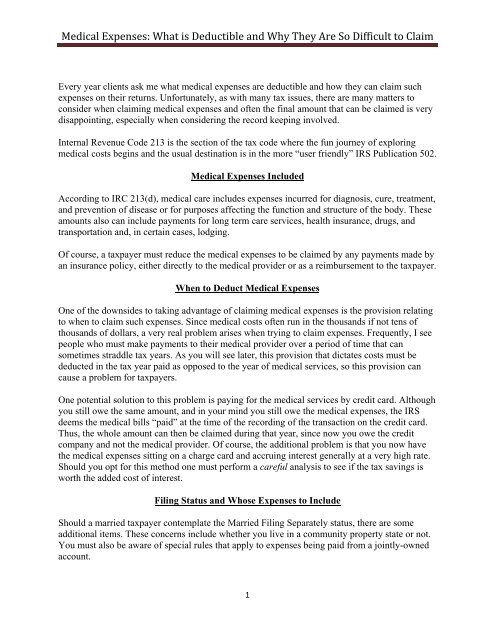

Medical Expenses: What is Deductible and Why They Are So

FSA Archives - Admin America

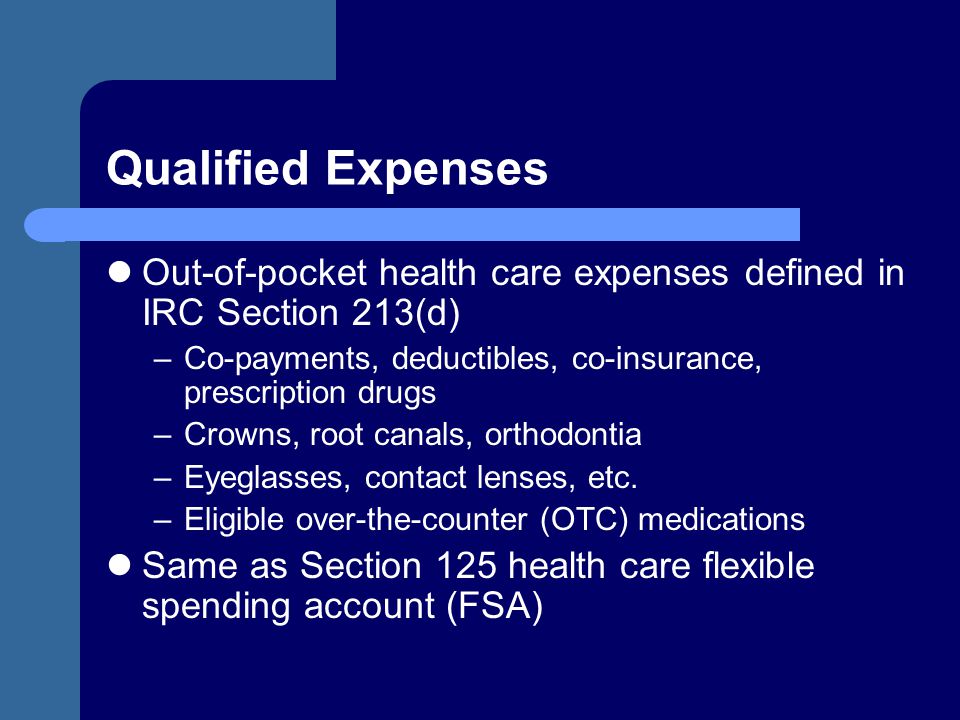

VEBA MEP A tax-free health reimbursement arrangement for Washington State employees in general government agencies and higher education institutions Presented. - ppt download

2024 COLAs - Health FSA, Qualified Transportation and More